This is the fourth in a series of posts aimed at analyzing the new tax laws that go into effect on January 1, 2018. There will still undoubtedly be numerous clarifications and corrections coming out over time as the IRS issues Regulations and Technical Corrections, so this is just a preliminary understanding. Meals and entertainment turned out to be an area of heavy focus for the reform and below we will tackle these changes.

Entertainment Expenses Eliminated

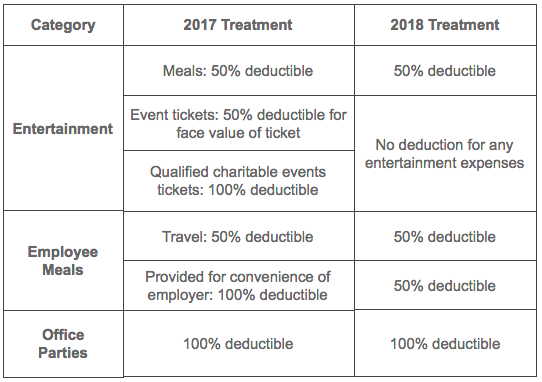

The new tax plan revises IRC Section 274 to remove the ability for taxpayers to deduct any expenses related to entertainment, amusement or recreation. Previously, these expenses were deductible as long as the taxpayer was able to establish that the activity was associated with the active conduct of their trade or business. This means that sporting events are no longer deductible regardless of how the tickets are used. Additionally, membership dues for any club organized for business, pleasure, recreation, or other social purposes will no longer be deductible.

Changes to Deductibility of Meals

Another area that was changed is meals. While normal meals remain at 50% deductible, the tax reform changes how meals that are provided for the convenience of the employer are treated. This includes food and beverages provided to employees through an eating facility that meets requirements for de minimis fringes. Historically, these were 100% deductible. These will now be limited to 50% deductible.

Office Parties Remain Intact

IRC Section 274(e)(4) lays out that expenses for recreational, social, or similar activities primarily for the benefit of employees are deductible. As the new tax plan is currently written, this section is not altered in any form. In order to qualify, an event must be open to all employees generally and not limited to a specific class or group of employees, particularly officers, shareholders or highly compensated employees. Examples of these events would be holiday parties, annual picnics or summer outings.

It is vital to stay up-to-date on how this new tax plan will impact your finances. At Malloy, Montague, Karnowski, Radosevich & Co., P.A. (MMKR), we strive to help all our clients create a solid strategy to protect their financial goals. If you are concerned about how this tax plan will affect your financial future, call our team today to schedule a consultation with one of our accountants.