Now is a good time to take a careful look at what has changed within the tax laws. Here are some of the many considerations that taxpayers should be aware of for 2019 and 2020.

2020 PAYROLL ITEMS

- Social Security Wages – Social Security wages for 2020 increases to $137,700, an increase of $4,800 from the 2019 wage of $132,900. Employee tax rates for 2019 remain unchanged for Social Security and for Medicare at 6.20 percent and 1.45 percent, respectively. Employer tax rates also remain unchanged for Social Security and for Medicare at 6.20 percent and 1.45 percent, respectively.

- Medicare Additional Tax – Withholding of an additional 0.9 percent Medicare tax is imposed on an employee only if an employee receives wages from the employer that exceed $200,000 for the year. The employer is not responsible for determining whether the employee is married, and the employer is also not required to match the additional 0.9 percent Medicare tax.

- Federal Unemployment Tax Act (FUTA) Rate – The tax deposit threshold is $500. No tax deposit is required until the tax is equal to or greater than $500. For 2019, the FUTA rate is 6.0 percent, less a 5.4 percent credit for paying into the state Unemployment Fund for a net adjusted rate of 0.6 percent. The 2019 and 2020 taxable wage base is $7,000.

- State Unemployment Tax Act Rate – The 2020 Minnesota taxable wage base remains increases to $35,000, a $1,000 increase from 2019.

- Federal Overtime Rule – Effective January 1, 2020, the U.S. Department of Labor will enforce new requirements for overtime pay. These new rules include raising the “standard salary level” from the currently enforced level of $455 to $684 per week, equivalent to $35,568 per year for a full-year worker. It also raises the total annual compensation level for “highly compensated employees” from $100,000 to $107,432 per year. Employers may now use nondiscretionary bonuses, incentive payments, and commissions that are paid at least annually to satisfy up to 10 percent of the standard salary level.

- Minimum Wage Increase – Effective January 1, 2020, Minnesota increases the minimum wage to $10.00 an hour for large employers with annual gross revenue of $500,000 or more; and $8.15 an hour for employers with annual gross revenue of less than $500,000. Training wage rate (ages 18-19) and youth rate (age 17 and under) are both $8.15 an hour for the first 90 days after the date of hire.

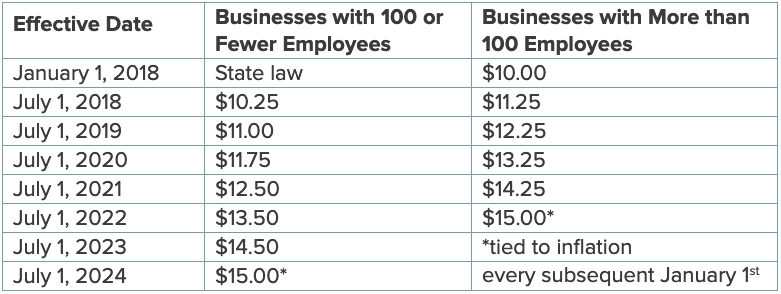

- Minneapolis Minimum Wage Ordinance – Minneapolis has set out to raise its minimum wage to $15 an hour over the course of the next few years. The table below lays out their plan.

Minneapolis allows for youth and training rates (ages 14-19), this rate cannot be lower than 85 percent of the city minimum wage for small employers. Additionally, this rate is only allowed for the first 90 days after the date of hire, afterward, the rate must match the applicable city minimum wage.

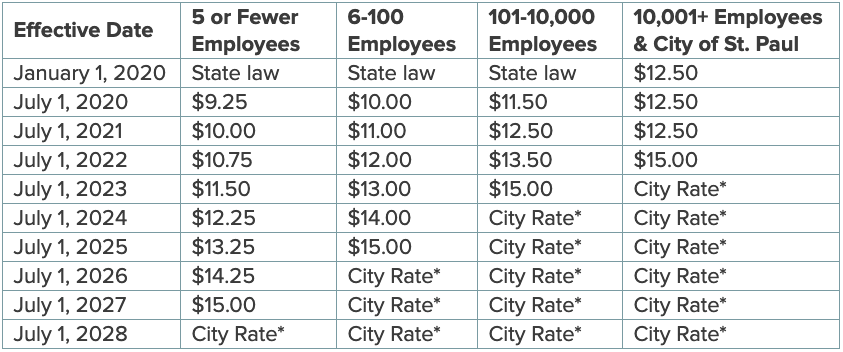

- St. Paul Minimum Wage Ordinance – Following the lead of Minneapolis, St. Paul has also started to increase its minimum wage effective January 1, 2020.

*The City Rate will be determined each year no later than September 1st to take effect on January 1st of each subsequent year.

St. Paul allows for youth and training rates (ages 14-19), this rate cannot be lower than 85 percent of the city minimum wage for small employers. Additionally, this rate is only allowed for the first 90 days after the date of hire, afterward, the rate must match the applicable city minimum wage.

- 401(k) and 403(b) – The maximum employee contribution for 2019 and 2020 is $19,000 and 19,500, respectively. Individuals age 50 by the end of the year may contribute an additional $6,000 for 2019 and $6,500 for 2020. Beginning January 1, 2020, part-time workers are allowed to participate in 401(k) plans.

- Simple IRA/401(k) – The maximum employee contribution for 2019 and 2020 is $13,000 and $13,500, respectively. Individuals age 50 or over may contribute an additional $3,000 for 2019 and 2020.

- Defined Contribution – The maximum employee/employer combined contribution for 2020 increases to $57,000, up from $56,000 in 2019. (And adding any respective catch-up contributions noted above). The deadline to contribute is the date your business tax return (with extension) is timely filed.

- IRA/Roth IRA – The maximum IRA/Roth IRA remains unchanged at $6,000. Individuals age 50 or over may contribute an additional $1,000. The deadline to contribute is the due date of the individual tax return (without extension). Effective January 1, 2020, the age for required minimum distributions is raised from 70 ½ to 72.

- Health Savings Account (HSA) Contributions – The HSA maximum family contribution for 2020 increases from $7,000 to $7,100 and the maximum single contribution increases from $3,500 to $3,550. If you are over the age of 54 and not on Medicare, an additional $1,000 for both family and single coverage may be contributed. The deadline to contribute or make corrections to avoid penalties is the due date of the individual tax return (excluding extensions).

- Flexible Spending Account (FSA) – The maximum contribution for 2020 is $2,750, which is a $50 increase from 2019.

If you have any questions or would like to speak with one of our certified public accountants regarding 2020 tax updates, please contact us through our website or give us a call at (952) 545-0424.

Stay tuned for future blogs regarding business and individual tax considerations!