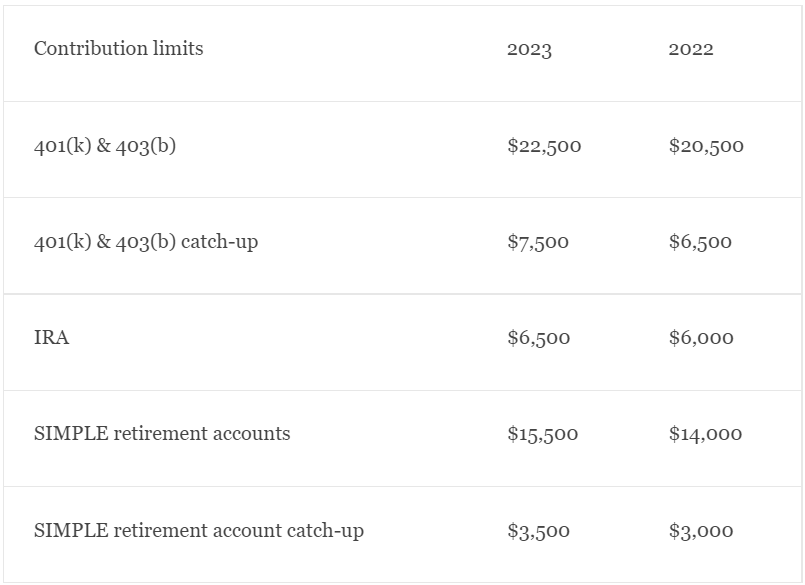

Last Friday, the IRS released the annual inflation adjustments for a variety of items in 2023. These adjustments are made every year to factor in cost-of-living changes and keep everything updated. They impact a number of items, but the most relevant relate to retirement plan contributions. The table below lays out what these items look like compared to 2022 figures.

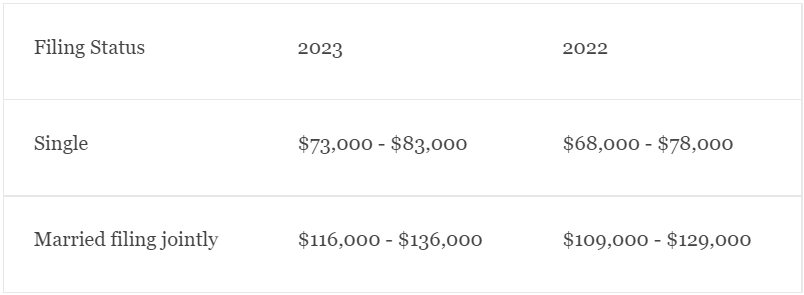

In addition to contribution limits, the IRS also unveiled the phaseout ranges for traditional IRAs:

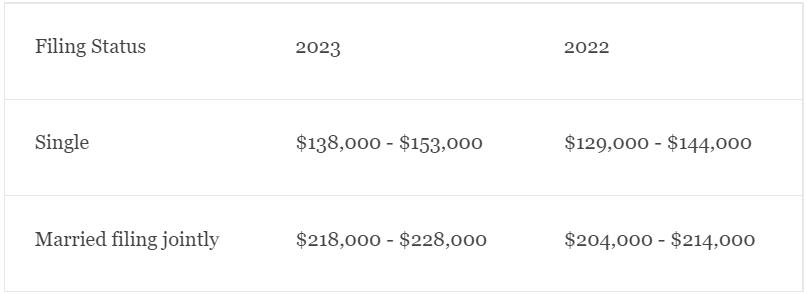

In addition to contribution limits, the IRS also unveiled the phaseout ranges for Roth IRAs:

At Malloy, Montague, Karnowski, Radosevich & Co., P.A. (MMKR), we stay up to date on the ever-changing tax world. If you are interested in how to best take advantage of these changes for your taxes, call our team today to schedule a consultation with one of our accountants.