- Due Dates of Business Tax Returns – The filing date for Form 1065 (Partnership return) was revised in 2016. The new filing deadline for 2019 Form 1065 is March 16, 2020. With this change, both Form 1065 and Form 1120S (S Corp return) will be due on March 16th. Additionally, Form 1120 (C Corp return) will now be due on April 15th.

- Tax Rates –Corporate tax rate for 2019 is 21.0 percent.

- W-2 and 1099-MISC. Filing Due Dates – The filing due date for Form W-2 and Form 1099MISC with an amount in Box 7 for non-employee compensation is January 31st. The filing deadline for all other Form 1099 and 1096 is February 28th if by paper and March 31st if filed electronically. However, the due date for giving the recipient these forms is January 31st.

- Section 179 Deduction – Section 179 provision permits taxpayers to expense up to $1,000,000 of the cost of qualifying property purchased before December 31, 2019. A dollar-for-dollar reduction in the Section 179 deduction begins when the investment exceeds $2,500,000. Both the Section 179 and the phase-out will be indexed for inflation. To qualify, the business use of the asset must be at least 50 percent. If during its life the usage drops below 50 percent you may be subject to recapture of the Section 179 deduction.

- First Year Additional Depreciation – Certain assets placed in service after September 27, 2017, qualify for 100 percent bonus depreciation for both new and used property. After December 31, 2022, a 20 percent per year phase-down of the bonus depreciation begins resulting in zero percent bonus in 2027.

- Vehicle Depreciation – The maximum depreciation limit under Section 280F for passenger automobiles (defined to include light SUVs, pickups, and vans) acquired before September 28, 2017 and first placed in service during 2019 is $10,100 for the first tax year. If the vehicle qualifies for bonus depreciation, first year depreciation is $14,900. Sport utility vehicles and pickup trucks with a gross vehicle weight rating in excess of 6,000 pounds are exempt from the luxury vehicle depreciation caps. The maximum depreciation limit for passenger automobiles acquired after September 27, 2017 and placed in service during 2019 is $10,100 ($18,100 if bonus depreciation is claimed).

- Mileage – For 2020, business mileage decreases from $0.58 to $0.575; medical travel and moving costs mileage decreases from $0.20 to $0.17; and charitable mileage remains at $0.14.

- Net Operating Losses – The Tax Cuts and Jobs Act also change the rules surrounding Net Operating Losses (NOLs). NOLs arising after 2017 can only be carried forward, eliminating the option for the two-year carryback. Certain farming businesses and insurance companies are still eligible for the two-year carryback. Additionally, when taking a net operating loss deduction is limited to 80 percent of taxable income. Rules for NOLs created prior to 2018 remain the same.

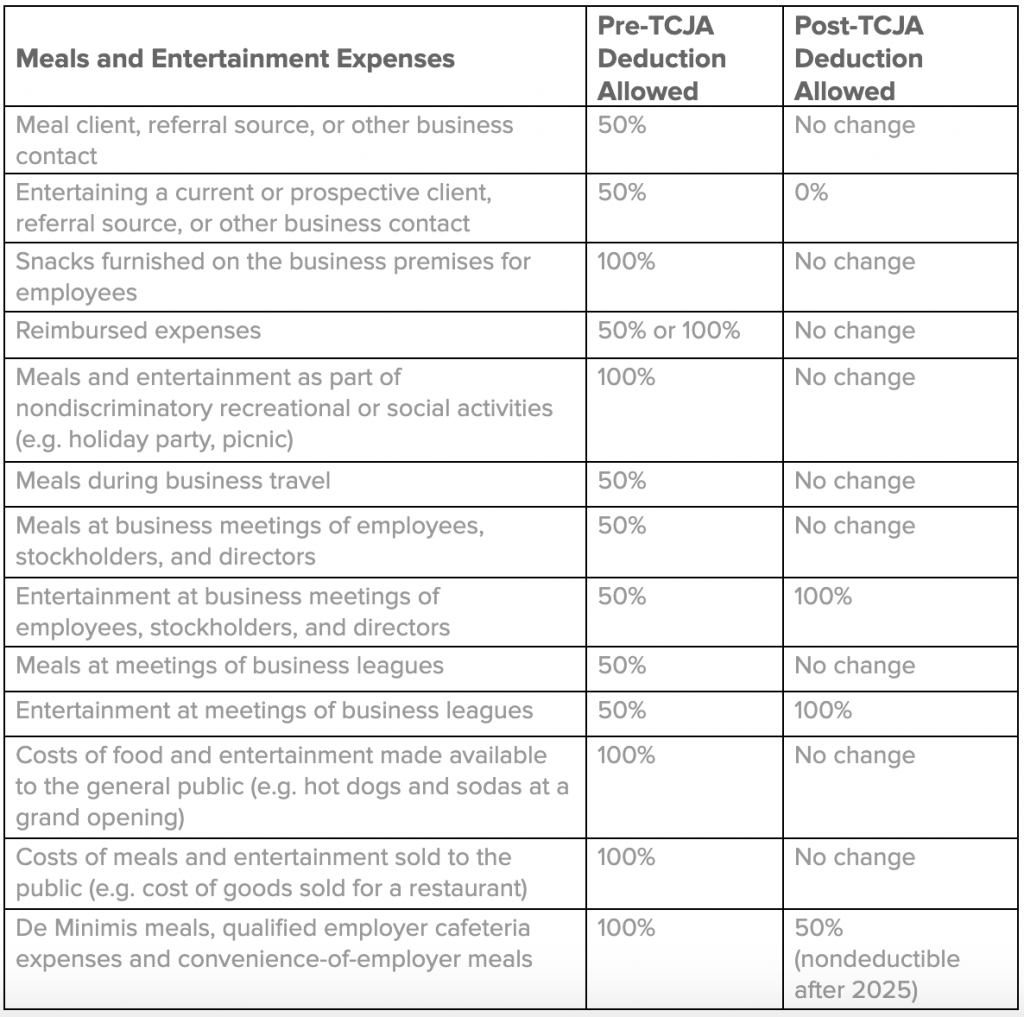

- Entertainment and Fringe Benefit Limitations – Beginning in 2018, no deduction is allowed for any activity considered entertainment, amusement, or recreational; no deduction is allowed for member dues at any club organized for business, pleasure, recreation, or other social purposes; and no deduction is allowed for a facility or portion of a facility used in connection with the preceding items. Exception to the rules include: entertainment treated as compensation on your filed tax returns and treated as wages to your employee; expenses for employee holiday party or a summer picnic; expenses related to attending business meetings or conventions of certain exempt organizations such as business leagues, chamber of commerce, etc.; and entertainment sold to customers.

- Meals and Beverages – Taxpayers may deduct 50 percent of ordinary and necessary business expenses that are not lavish or extravagant; the taxpayer, or an employee of the taxpayer, is present when the food or beverage is furnished; the food and beverages are provided to a current or potential client, consultant, or business contact; and the food and beverages provided during or at an entertainment activity is stated separately from the cost of the entertainment. The following chart summarizes the deductibility of meals and entertainment:

- Sales Tax and Commercial Activity Tax – Due to recent Supreme Court rulings, certain companies may be subject to sales and use along with commercial activity taxes even if the companies have no physical presence or payroll within the state. Careful review of state laws should be conducted on an annual basis to ensure compliance with state rules relating to non-income tax issues.

- Domestic Production Activities – The deduction for domestic production activities is repealed for tax years beginning after December 31, 2017.

- Qualified Business Income Deduction – Tax reform created a new deduction for eligible businesses that is taken on the individual tax returns of the owners. This deduction has various requirements that when met typically results in a deduction of 20 percent of the qualifying business income from each eligible entity.

- Research Tax Credit – The credit for increasing research activities remains at 14 percent for the alternative simplified method. Eligible small businesses can use this credit to apply against the alternative minimum tax liability for timely filed returns for years beginning after December 31, 2015. Start-up businesses with no income tax liability and gross receipts less than $5 million may take this credit against payroll taxes. Beginning after December 31, 2021, specified research or experimental expenditures (including software development costs) under Section 174 should be capitalized and amortized ratably over a five-year period. Research that is conducted outside the United States and United States possession would be capitalized and amortized ratably over a 15-year period. Taxpayers currently deducting research and experimental costs in the year incurred will be required to file an Application for Change in Accounting Method (Form 3115) to begin capitalizing and amortizing such costs for tax years beginning after December 31, 2021.

- Work Opportunity Tax Credit (WOTC) – The SECURE Act extended this through 2020.

- Form 1095-C Reporting – Large employers, employing 50 or more full-time equivalent employees in 2019, must report information to the IRS on health care coverage (if any) offered to full-time employees. A separate Form 1095-C is required for each full-time employee with a copy submitted to the IRS. Form 1095-C must be filed with the IRS annually by February 28th (March 31st if filed electronically) following the calendar year in which coverage was provided. Form 1095-C must also be furnished to the employee by January 31st. (Employers who are self-insured should use Form 1094-B to report information to the IRS and to each individual employee.

- Form 1099-MISC – Companies that make payments in excess of $600 ($10 in royalties) to individuals must give the payee a Form 1099-MISC. If the company fails to issue the

Form 1099-MISC, the company may be subject to a penalty. The amount of the penalty is based on when you file the correct information return, ranging from $30 per information return to $100 per information return.

If you have any questions or would like to speak with one of our certified public accountants regarding 2020 business tax updates, please contact us through our website or give us a call at (952) 545-0424.