The Minnesota Department of Revenue has begun to adjust tax returns from 2019 and 2020. As a result of these adjustments, a number of taxpayers are receiving notices that they owe additional tax for these two years. These notices started to pop up late last year before the state paused the process for the 2021 tax filing season.

The state has retroactively updated the standard deduction limitation worksheet that is included in the instructions for the 2019 and 2020 tax returns. The original instructions included an incorrect worksheet that resulted in all returns utilizing it being incorrect. Minnesota explains this on the last page of the notice. This is entirely a result of an error on the state’s end when the returns were originally filed.

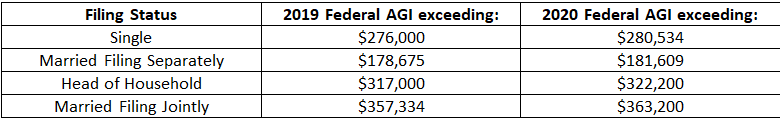

The chart below will help you determine if your return will be impacted by these updates.

If you receive this notice from the state of Minnesota, please forward it along to us. At Malloy, Montague, Karnowski, Radosevich & Co., P.A. (MMKR), we strive to avoid notices upfront, but in the ever-changing tax world, there are some notices that are inevitable. This notice is one that is a result of the state changing forms after the fact. If you are concerned about how this will impact your taxes, call our team today to schedule a consultation with one of our accountants.